Accounts Payable

Accounts Payable is responsible for processing payments to vendors and employees in a timely, accurate, and efficient manner in order to facilitate and support the University’s goals and objectives.

Services provided by Accounts Payable include:

- Supplier Payments and Analysis

- Travel Claim Reimbursement

- Supplier Profiles and Updates

CSU Long Beach pays or reimburses for travel related expenses that are ordinary, reasonable, not extravagant, and necessary to conduct official University business. All expense reimbursements and business travel arrangements must comply with University procedures, prudent accounting practices, and applicable collective bargaining agreements:

The policies apply to all hospitality expenses, awards and non-cash gift expenses incurred by the University, the Foundation, The Forty Niner Shops and Associated Students Inc.

Accounts Payable Invoice Approval Process

Suppliers are to send invoices directly to the Accounts Payable Department. Once an invoice is received, an Accounts Payable Technician will enter it into PeopleSoft to ensure visibility.

If the invoice includes a Purchase Order (PO) number, the technician will link the corresponding voucher to the related PO in the CFS system.

Invoices for goods that have already been marked as received by the Receiving Department will be processed for payment automatically, with no further action required from the requesting department.

Invoices for services must be reviewed and approved by the appropriate administrator from the requesting department to confirm that the services were satisfactorily completed. After entering the invoice, the technician will send a stamped copy to the department for approval.

Actions to Approve Invoice

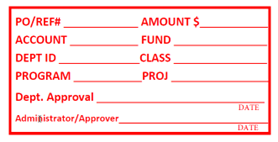

Complete the information requested within the stamp

Fill out all required information within the stamp area:

- PO/Reference Number: Enter the Purchase Order (PO) number. If no PO was issued, provide the Department Reference Number instead.

- Chart Fields: Complete the chart fields only if the invoice is not associated with a Purchase Order (PO). For PO-related invoices, the chart fields from the PO will be used by default. If you need to override the PO’s chart fields, clearly indicate the changes on the invoice and include a note for the Accounts Payable Technician.

- Signatures: For items not tied to a PO, two authorized signatures are required.

- Special Payment Instructions: Clearly write any specific payment directions (e.g., “Finalize PO with payment”) on the front of the invoice.

- Send the approved invoice as a single PDF to fisinvoiceapproval@csulb.edu.

PO# Receiving Required (3-Way Match PO):

Sometimes, goods ordered under a Purchase Order that requires receiving are delivered directly to a campus department instead of the central Receiving dock. In such cases, the department must notify the Receiving team via email and request that the items be officially received in the PeopleSoft system for the specific PO number.

Once the items are recorded as received, a receipt number will be issued to the department. After this step is completed in PeopleSoft, Accounts Payable can proceed with processing the payment.

Direct Payment Request (Non-PO Invoices):

For invoices that are not associated with a Purchase Order or are sent directly to a department, a Direct Payment Request Form must be completed. This form gathers all necessary information to process the payment, including:

- Payee details

- Chart fields

- A description of the business purpose for the expense

- Required approval signatures

The supplier’s invoice must be attached to the completed Direct Pay form.

Once complete, submit both the form and the invoice to Accounts Payable via email at FISINVOICEAPPROVAL@CSULB.EDU.

Employee/Student Reimbursements:

To request a reimbursement, employees or students must complete the Direct Payment Request Form. The form must be signed by the individual requesting reimbursement, and all relevant receipts must be attached.

Hospitality, Gifts, and Awards:

Certain types of direct payments—such as those related to hospitality expenses, gifts, or awards—may require a different form, such as the Hospitality, Gift, and Awards Form. All relevant receipts, attendee lists etc. must be attached. Once all required documentation is completed and approved, submit a single PDF file containing all materials to FISINVOICEAPPROVAL@CSULB.EDU.

Important Reminder: Email Subject Line Format for Approvals

When submitting approved invoices or payment requests to Accounts Payable, please ensure the email subject line follows this format:

Business Unit – Vendor/Employee/Student Name – Invoice Number (if applicable) – PO Number (if applicable)

Using this format helps ensure timely and accurate processing.

For all transactions that will lead to a Supplier payment by the University, the Supplier must have the appropriate tax forms on file with the Accounts Payable department. The Supplier’s U.S. and California State residency status will determine the type of tax forms required.

For all U. S. based entities or individuals, a Supplier 204 form is required. Depending on both the company’s status with the state of California and the type of transaction, supplemental State tax forms may be required as well. The DocuSign 204 form will guide the Supplier through the process. The DocuSign 204 form must be initiated by a Campus employee and can be found on the Forms page behind SSO along with the instructions.

For any Supplier who declares that the company is a foreign entity and does not have U.S. Tax ID, an IRS W8 form will replace the Supplier 204 form. When goods and/or services are being acquired from a foreign entity, contact the Tax Services department for further assistance.