Investing in the Future

The CSULB endowment is managed by the CSULB 49er Foundation Board of Directors. It is comprised of hundreds of individual funds established by donors for a particular purpose. Some of these funds support scholarships, while others support annual lectures, departments, and programs.

The endowment is invested in a combination of domestic and international equities, fixed-income instruments, real estate, and alternative investments, with the goal of achieving the maximum rate of return with an acceptable, prudent level of risk. As of June 30, 2017, the endowment was valued at $ 66,613,450.

| Annualized Returns | As of June 30, 2017 |

|---|---|

| Fiscal YTD 1 Year |

11.33% |

| 3 Year | 3.61% |

| 5 Year | 7.16% |

*Performance results are annualized for time periods greater than one year and include all cash and cash equivalents, realized and unrealized capital gains and losses, and dividends, interest and income. Time weighted returns do not include the impact of fund contributions and withdrawals and therefore, may not reflect the actual rate of return of a specific fund.

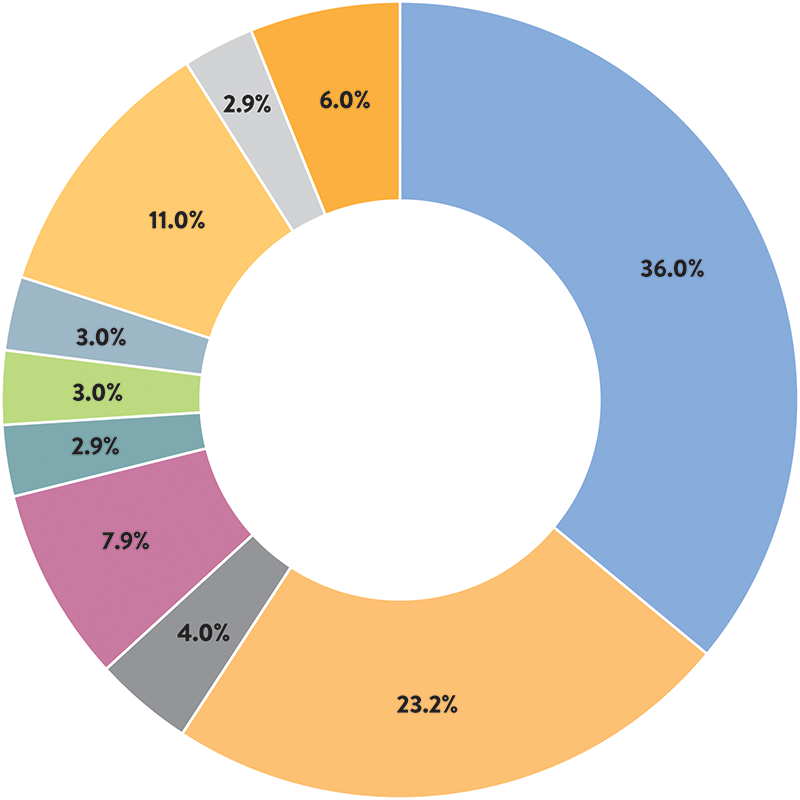

BY THE NUMBERS

- U.S. Equity 36.0%

- International Equity 23.2%

- Equity Return Assets 4.0%

- Equity Hedge Assets 7.9%

- Absolute Return Assets 2.9%

- High Yield Fixed Income 3.0%

- Inflation Linked Sectors 3.0%

- US Fixed Income Taxable 11%

- Short Term Fixed Income 2.9%

-

Emerging & Frontier Market 6.1%

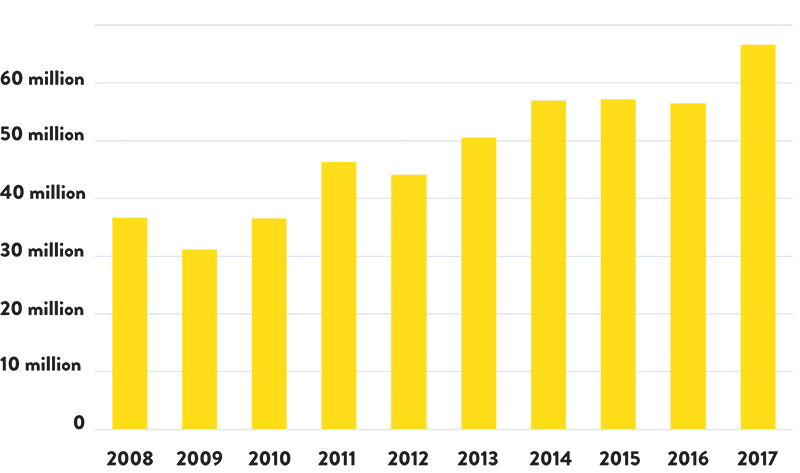

- 2008 - $ 36,616,440

- 2009 - $ 31,070,238

- 2010 - $ 36,563,865

- 2011 - $ 46,269,016

- 2012 - $ 44,084,299

- 2013 - $ 50,528,887

- 2014 - $ 57,000,071

- 2015 - $ 57,190,877

- 2016 - $ 56,442,378

- 2017 - $ 66,613,450